What is a Limited Recourse Borrowing Arrangement?

Under the Superannuation (Industry) Supervision Act 1993 (Cth) (SIS Act), a Self-Managed Superannuation Fund (SMSF) is prohibited from borrowing money to acquire an asset - except in some limited cases. One of these is where the acquisition is part of a limited recourse borrowing arrangement (s 67A SIS Act) (LRBA), which allows an SMSF to borrow money to purchase an asset (for example, a property). An LRBA also requires that a bare trustee/custodian be appointed to hold the property on behalf of the SMSF and, if required, grant security over the property in favour of the lender.

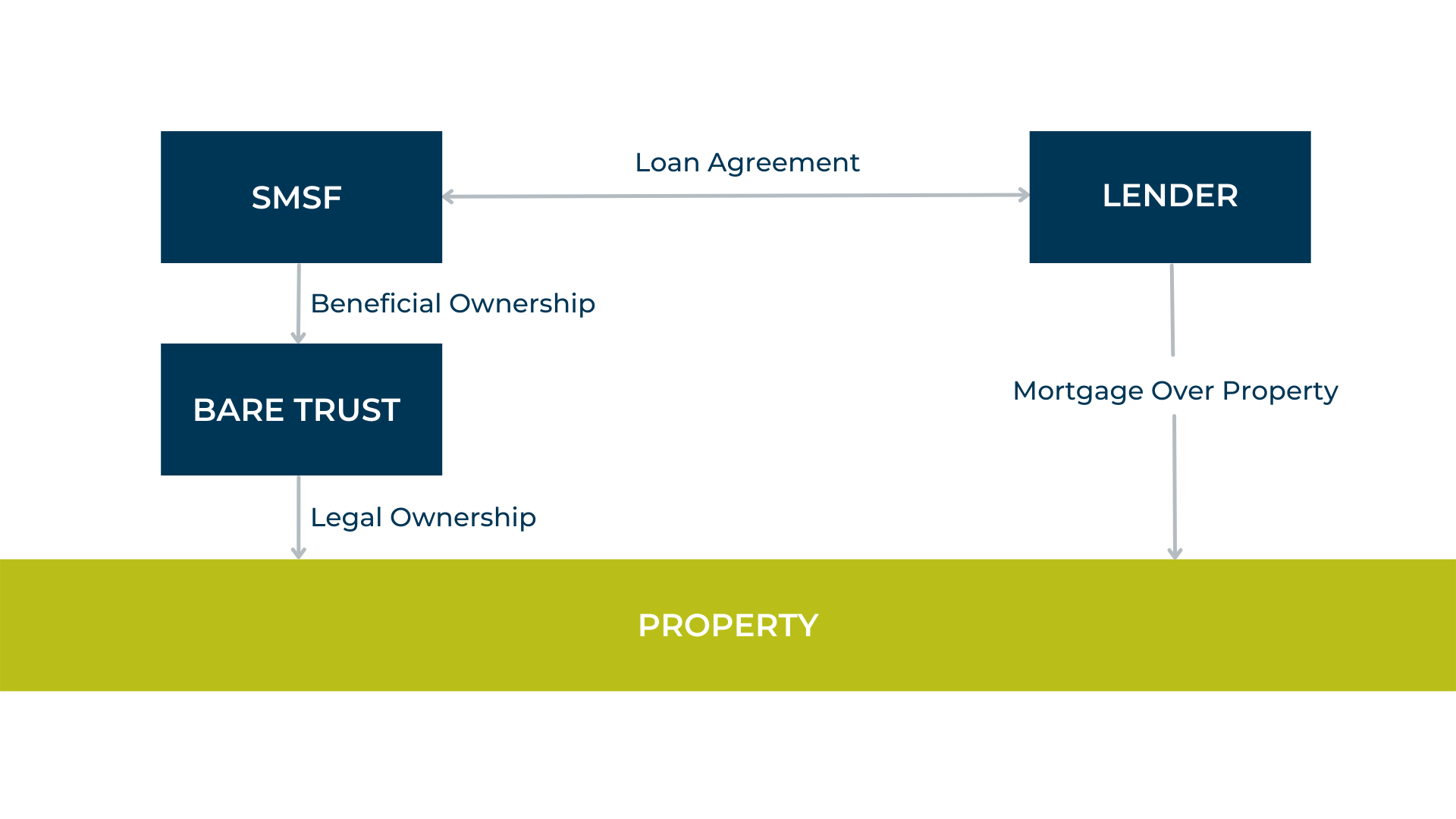

A typical arrangement looks as follows:

Who is the Buyer on the contract for property in queensland?

The buyer on the purchase land contract must be the entity that holds legal title (ownership) of the property, which in this case is the trustee of the Bare Trust. For Queensland property only, and depending on whether the Bare Trust has individual persons as trustees or a corporate trustee, this can be expressed as [TRUSTEE] as trustee for [BARE TRUST]. For example:

- In the case of individual trustee/s – "James Smith and Sandy Smith as trustees for the Smith Bare Trust"

- In the case of a corporate trustee – "JS & SS Smith Pty Ltd as trustee for the Smith Bare Trust"

For properties in Queensland, we recommend that the trustee (buyer) is listed as holding the property on trust. That is, that the Bare Trust be disclosed or shown on the title to avoid any argument that the custodian is holding the property personally. To do so, the buyer should be shown as "JS & SS Smith Pty Ltd as trustee for the Smith Bare Trust" in full rather than "JS & SS Smith Pty Ltd".

For Queensland property, ensure that the Bare Trust deed is executed properly before entering into the property contract. This includes completing any property information in the Schedule of the Bare Trust deed.

Each state has different titling requirements, conveyancing procedures and transfer duty consequences for properties purchased as part of an LRBA. We recommend that you speak to your solicitor/conveyancer before executing any contract to ensure that the buyer is stated correctly.

Consequences of Getting it wrong

It is important to ensure that the buyer is correctly identified on the property contract. Otherwise, the arrangement:

- May not meet the SIS Act requirements (resulting in penalties and additional costs to the SMSF); and

- May attract additional transfer duty and legal fees.

Approaching A Lawyer

Our Superannuation team has many years of experience assisting clients with LRBAs and their related matters. We are more than happy to provide you with quality advice and service - whether you are simply interested in hearing more about this topic or if you need some assistance with your own LRBA.

Simply fill out the enquiry form below and mention this article for an obligation-free appointment.

Solicitor